Boost your business with the right software!

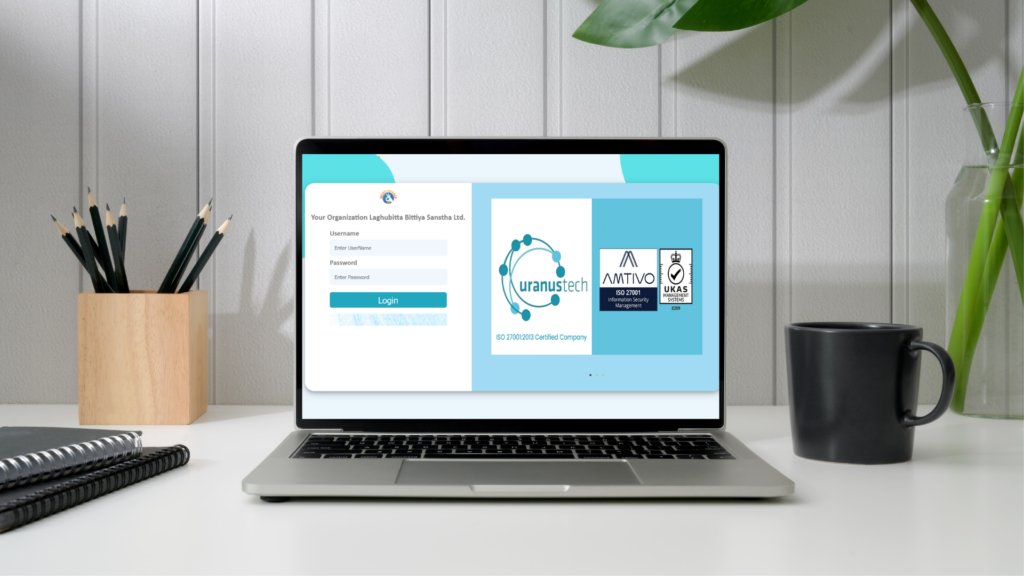

Uranus Solution:

Cloud-Based Microfinance Software for Nepal’s Financial Landscape

Introduction:

Uranus Solution is a comprehensive cloud-based software designed to meet the specific technological needs of financial institutions in Nepal, including D-class Microfinance Institutions licensed by Nepal Rastra Bank, FINGOs, and cooperative-run microfinance programs. Its multi-tiered and distributed architecture ensures high availability, scalability, and cost-effectiveness for rural deployments.

Key Features:

- Cloud-Ready: Fully tested and operable on both private and public clouds, making it ideal for remote locations with limited resources.

- Scalability: Modules can be shared or distributed across servers for increased capacity and availability.

- Centralized Data: Offers a centralized database system for consolidated reporting and transparency, with decentralized working modules accessible via web platform.

- Automated Processes: Automates manual tasks, implements controls, and generates reports for efficient decision-making and improved ROI.

- Microfinance-Specific Tools: Tailored features address the unique challenges of microfinance operations, including performance measurement and multi-dimensional reporting.

- Dedicated Support: Uranus Tech Nepal goes beyond software sales, providing hands-on support and collaboration to ensure seamless software integration and production smooth operation.

Benefits for Microfinance Institutions:

Increased operational efficiency and cost savings.

Enhanced data visibility and reporting for informed decision-making.

Improved compliance and risk management.

Scalable infrastructure to meet future growth needs.

Dedicated support and partnership for successful implementation.

Experience and Expertise:

With over six years of experience in the microfinance software field, Uranus Tech Nepal has a deep understanding of deployment scenarios and challenges faced by financial institutions in Nepal.

Call to Action:

Contact Uranus Tech Nepal today to learn how Uranus Solution can empower your microfinance institution to achieve greater success.

Additional Improvements:

- Consider specifying the minimum hardware requirements for running the software.

- Include screenshots or video demonstrations to showcase the user interface and features.

- Quantify the benefits wherever possible (e.g., “reduce manual tasks by 30%”).

- Provide case studies or testimonials from satisfied customers.

By implementing these suggestions, you can create a more compelling and informative description of Uranus Solution, effectively attracting and engaging potential clients in Nepal’s thriving microfinance sector.

Our Products